HIGHLIGHTS

Insta Cashback

within 7 days*

of

your annualized

premium

Guaranteed^

Annual Income

Lump sum

maturity benefit

Flexi Wallet – Save

or withdraw

your

income as needed

Tax Benefits$

Optional riders

for enhanced

protection

You are rewarded with instant liquidity at the beginning of your policy by means of Insta income payout which is upto 50% of your Annualized Premium. In addition, from the beginning of the second policy year, you will receive guaranteed income till the end of the policy term and a guaranteed lumpsum benefit at maturity. The Insta Cashback amount will be paid within 7 working days from the date of realization of first year's premium by the Company or the issuance of the Policy, whichever occurs later. Let us understand the variant with the help of an example.

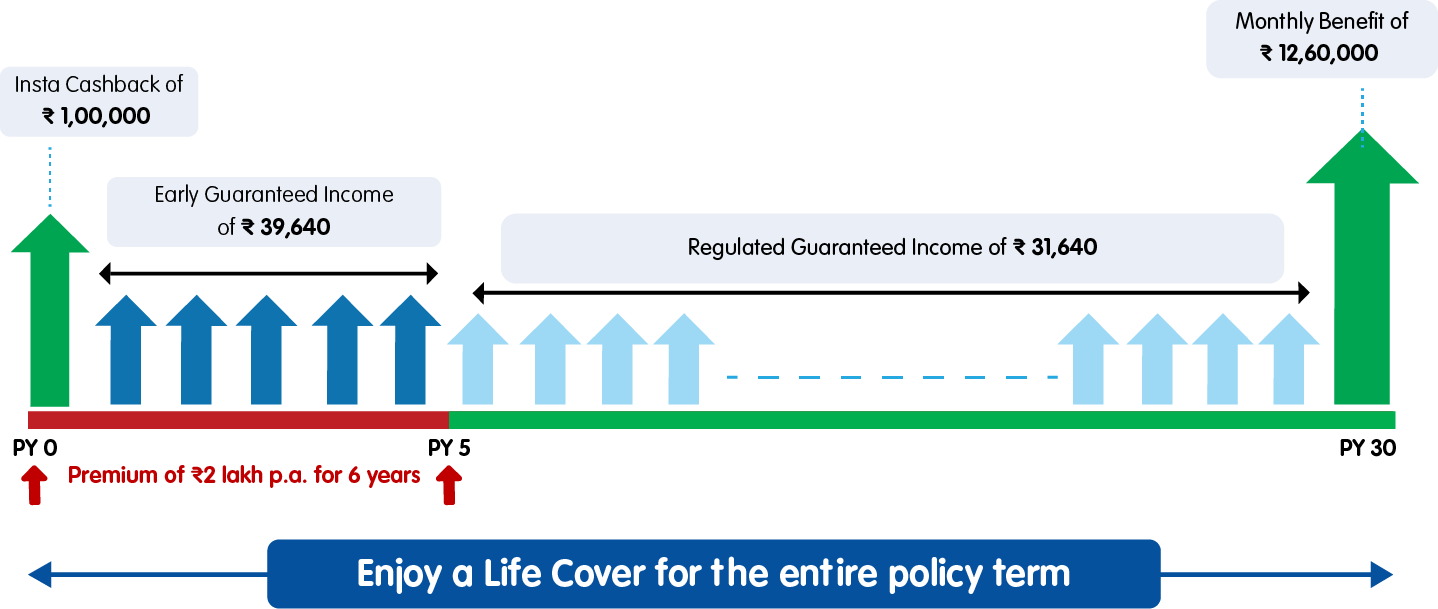

Example :

Mr. Arjun Mehta, a 35-year-old corporate employee, is focused on creating a financially stable future for his family while also building a regular stream of guaranteed income. To achieve this, he opts for the RNL Guaranteed Advantage Income Plan – Insta Income Variant.

Premium Payment Term (PPT)

6 years

Policy Term (PT)

30 years

Annual Premium

₹ 2 Lakhs

Insta Cashback percentage

50%

The plan provides long term life cover to Mr. Mehta till the age of 65 years, to keep his family financially secured in case of an unfortunate death.

After payment of the first-year premium, he receives an Insta Cashback of ₹1 Lakh within 7 working days providing instant liquidity. From the beginning of the 2nd policy year to the 6th policy year, he receives an Early Guaranteed Income of ₹ 39,640 annually. From the beginning of the 7th policy year till the 30th policy year, Mr. Mehta receives a Regular Guaranteed Income of ₹ 31,640 annually.

At the end of the 30th policy year, Mr. Mehta receives a Guaranteed Maturity Benefit of ₹12.60 Lakhs, which can be used for key milestones such as children's education or retirement planning.

In total, Mr. Mehta receives over ₹23.17 Lakhs in guaranteed benefits over the policy term, along with life insurance protection throughout ensuring a balanced mix of liquidity, regular income, and long-term financial security for his family.

Mr. Mehta’s Benefits

Amount (in ₹)

Insta Cashback (A)

1 Lakh

Total Early Guaranteed Income in 5 years (B)

1.98 Lakhs

Total Regular Guaranteed Income in 24 years (C)

7.59 Lakhs

Guaranteed Maturity Benefit (D)

12.60 Lakhs

Total Guaranteed Benefits Received (A+B+C+D)

23.17 Lakhs

Total Premiums Paid

12 Lakhs

The premium mentioned above is for a healthy male and is exclusive of any loadings and taxes.

Starting from the end of the 1st policy year, you will receive guaranteed income till the end of the policy term and a lumpsum at maturity. Let us understand the variant with the help of an example.

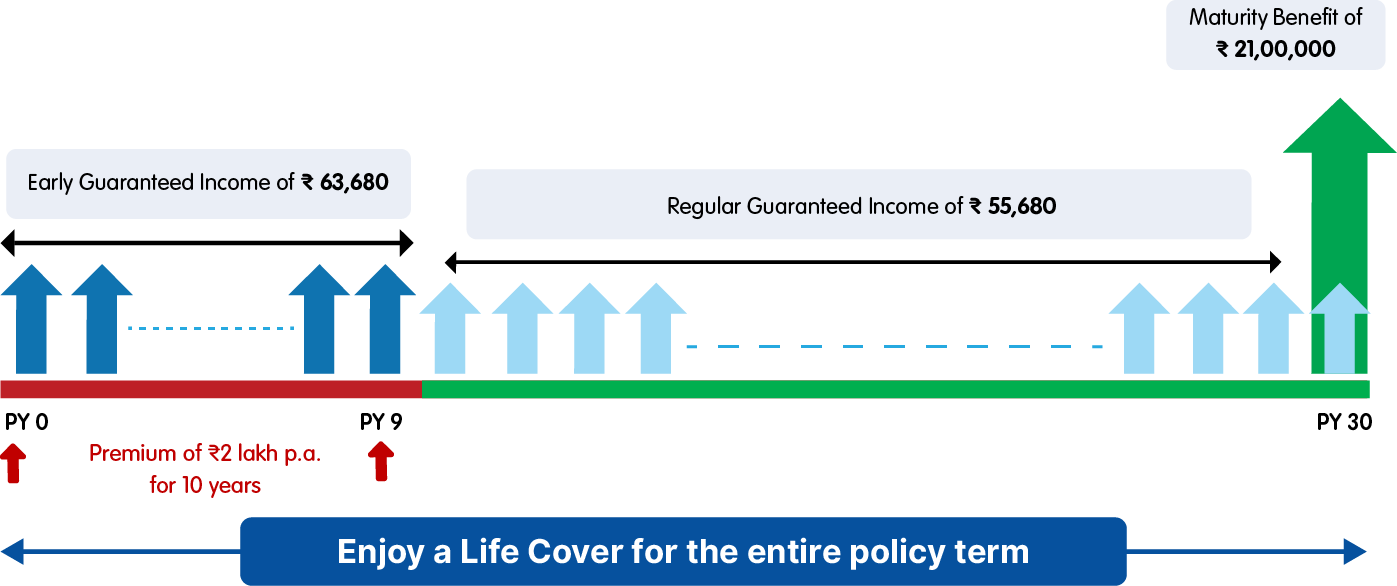

Example :

Mrs. Rajvi Nair, a 35-year-old senior marketing executive, is looking for a solution that offers immediate income support, long-term financial discipline, and protection for his family. She selects the RNL Guaranteed Advantage Income Plan – Early Income Variant.

Premium Payment Term (PPT)

10 years

Policy Term (PT)

30 years

Annual Premium

₹ 2 Lakhs

The plan provides long term life cover to Mrs. Nair till the age of 65 years, to keep her family financially secured in case of any unforeseen event.

Starting from the end of 1st year, Mrs. Nair begins receiving an Early Guaranteed Income of ₹63,680 annually till the end of the premium payment term. From the end of the 11th policy year till the 30th policy year, Mrs. Nair receives a Regular Guaranteed Income of ₹55,680 annually. This steady stream of income helps her manage ongoing expenses like children’s school fees, family health care, or annual travel plans, providing enhanced financial flexibility year after year. At the end of the 30th policy year, she receives a lump sum guaranteed maturity benefit of ₹21 Lakhs, which she plans to use towards her retirement corpus or to help fund her child’s important life stages like higher education, career goals or marriage.

Over the policy term, Mrs. Nair receives total guaranteed benefit of over ₹38.50 lakhs, apart from life cover throughout the policy duration. With its combination of immediate income, long-term savings, and insurance protection, RNL Guaranteed Advantage Income – Early Income Plan Variant empowers Mrs. Nair to secure both her present and future needs in a structured and guaranteed manner.

Mrs. Nair’s Benefits

Amount (in ₹)

Total Early Guaranteed Income in 10 years (A)

6.36 Lakhs

Total Regular Guaranteed Income in 20 years (B)

11.13 Lakhs

Guaranteed Maturity Benefit (C)

21 Lakhs

Total Guaranteed Benefits Received (A+B+C)

38.50 Lakhs

Total Premiums Paid

20 Lakhs

The premium mentioned above is for a healthy female and is exclusive of any loadings and taxes.

Eligibility Criteria

| Premium Payment Term (PPT) (in years) | 6 / 7 / 8 / 10 / 12 | |||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Policy Term (in years) | 20 / 25 / 30 / 35 / 40 | |||||||||||

| Minimum Age at Entry1 (in years) | 30 days | |||||||||||

| Maximum Age at Entry1 (in years) |

|

|||||||||||

| Minimum Age at Maturity1 (in years) | 20 years | |||||||||||

| Maximum Age at Maturity1 (in years) |

|

|||||||||||

| Minimum Annualized Premium (AP) (in ₹) | ₹35,000 | |||||||||||

| Maximum Annualized Premium (in ₹) | No limit, subject to Board Approved Underwriting Policy | |||||||||||

| Premium Payment Frequency |

Insta Income – Yearly Early Income – Yearly, Half-Yearly, Quarterly, Monthly |

|||||||||||

| Coverage for |

All Individuals (Male | Female | Transgender) Transgenders shall be covered as per the Board Approved Underwriting Policy of the Company. |

1All the references to age are based on age last

birthday.

The product shall be available for both online and offline sale.

Why Reliance Nippon Life Insurance?

FAQ's

• RNL Accidental Death Benefit Rider

• RNL Accidental Death and Disability Rider

• RNL Accidental Death and Disability Plus Rider

• RNL Critical Illness Rider

These riders provide additional protection in case of accidents or critical illnesses