Highlights

-

INCREASING ANNUAL INCOME

-

LONG TERM GUARANTEE

-

MULTIPLE INCOME PERIODS

-

PROTECTION THROUGHOUT THE POLICY TERM

-

OPTION TO ACCUMULATE IN FLEXI WALLET

-

POTENTIAL TAX BENEFITS*

Example

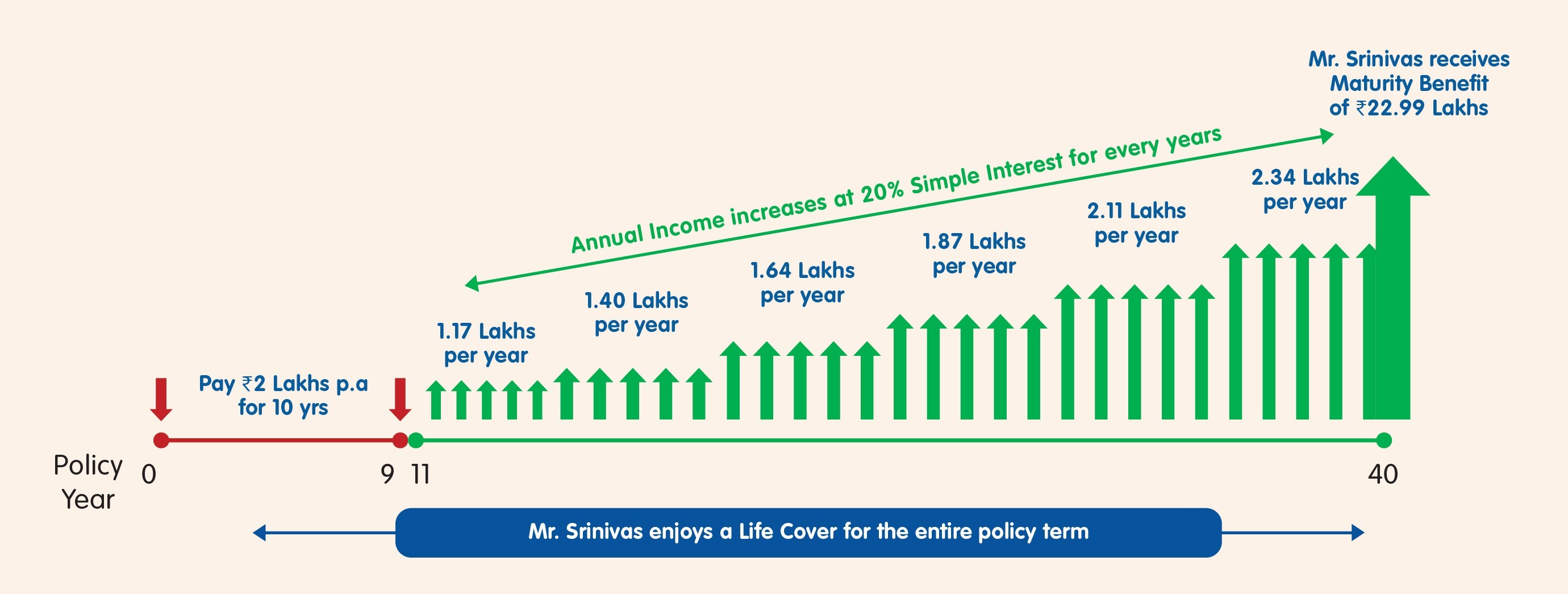

Mr. Srinivas is a 45-year-old professional who is looking for a plan to secure his golden years. He purchases Reliance Nippon Life Nishchit Ace that would provide him Annual Income for retirement which will increase at the end of every 5 years by an amount equal to 20% of the Annual Income at the start of the Income Period, so that he is less worried about the increasing cost of living.

| Premium Payment Term (PPT) | 10 years |

| Deferment Period (DP) | 0 years |

| Income Period (IP) | 30 years |

| Policy Term (PT) | 40 years |

| Annual Premium | Rs. 2 Lakhs |

The plan provides long term life cover to Mr. Srinivas till the age of 85 years, to keep his family financially secured in case of an unfortunate death.

Mr. Srinivas would receive Annual Income from the age of 56 years till the age of 85 years i.e. from 11th to 40th policy year, provided all due premiums have been paid. The Annual Income at start of Income Period i.e. at the end of 11th policy year shall be of Rs. 1.17 Lakhs and it would keep on increasing at the end of every 5 years by an amount equal to 20% of the Annual Income at the start of the Income Period. In addition to the income stream, Mr. Srinivas would also receive a lump sum Maturity Benefit of Rs. 22.99 Lakhs at end of Policy Term, which can be used for self or to be left as a legacy for the family.

| Mr. Srinivas's Benefits | Amount (in Rs.) |

|---|---|

| Total Annual Income in 30 years (A) | 52.76 Lakhs |

| Maturity Benefit (B) | 22.99 Lakhs |

| Total Benefits Received (A+B) | 75.75 Lakhs |

| Total Premiums Paid | 20 Lakhs |

The premium mentioned above is for a healthy male and is exclusive of any loadings and taxes

Eligibility Criteria

| Premium Payment Term - PPT (in years) | 5 | 6 | 7 | 8 | 10 |

| Deferment Period - DP (in years) | 5 | 4 | 3 | 2 | 0 |

| Income Period - IP (in years) | 15 / 20 / 25 / 30 | ||||

| Policy Term - PT (in years) | PPT + DP + IP | ||||

| Minimum Age at Entry (in years) | 1 year | ||||

| Maximum Age at Entry (in years) | 55 years | ||||

| Minimum Age at Maturity (in years) | 26 years | ||||

| Maximum Age at Maturity (in years) | 85 years | ||||

| Minimum Annualized Premium (in Rs.) | 75,000 | ||||

| Maximum Annualized Premium (in Rs.) | No limit, subject to Board Approved Underwriting Policy | ||||

| Coverage for |

All

Individuals (Male | Female | Transgender) Transgenders shall be covered as per the Board Approved Underwriting Policy of the Company. |

||||

All the references to age are as on last birthday.

Faqs

Reliance Nippon Life Nishchit Ace is a non-linked, non-participating individual savings life insurance plan that provides both life insurance protection and guaranteed returns.

- You are required to pay the premiums for the chosen Premium Payment Term.

- From the end of 11th policy year, the plan will payout Annual Income which is guaranteed during the whole Income Period. The Annual Income will increase at a simple rate of 20% every 5th year

- At the end of the Policy Term, a lumpsum benefit will be paid to you and your policy will be terminated.

- The Premium Payment Terms available under the plan are 5, 6, 7, 8 and 10 years.

- The Income Periods available are 15, 20, 25 and 30 years.

In case of the unfortunate death of the Life Assured during the Policy Term, provided the Policy is In-force for full benefits i.e. all due premiums have been paid, the following lump sum Benefit shall be payable immediately to the Claimant(s):

Higher of:

- Sum Assured on Death; and

- Death Benefit Factor multiplied by Total Premium Paid as on the date of death of the Life Assured

Where Sum Assured on Death is higher of 11 times Annualized Premium and Base Sum Assured. Kindly refer the plan’s Brochure for Death Benefit Factor. Apart from the above, the Claimant(s) also shall receive outstanding balance, if any, in the Flexi Wallet.

Flexi Wallet is a customized feature where you have an option to accumulate the Annual Income in Flexi-wallet instead of availing the same as a periodic payment during the Income Period. The amount in the Flexi Wallet will also earn interest and the same will be credited at the end of each month. At any time, you have an option to withdraw, completely or partially, the balance in the Flexi Wallet. You can opt-in opt-out of this feature anytime during the Policy Term.

You can enhance your coverage with the following optional riders:

- Accidental Death Benefit Rider

- Accidental Death and Disability Rider

- Accidental Death and Disability Plus Rider

- Critical Illness Rider

These riders provide additional protection in case of accidents or critical illnesses.