On survival of the life assured till the end of the policy term, provided all due premiums are paid in full, Sum Assured on Maturity plus Fixed Loyalty Addition, if any, shall be payable.

Loyalty Addition, if any, shall be payable.

Where, Sum Assured on Maturity is equal to Base Sum Assured.

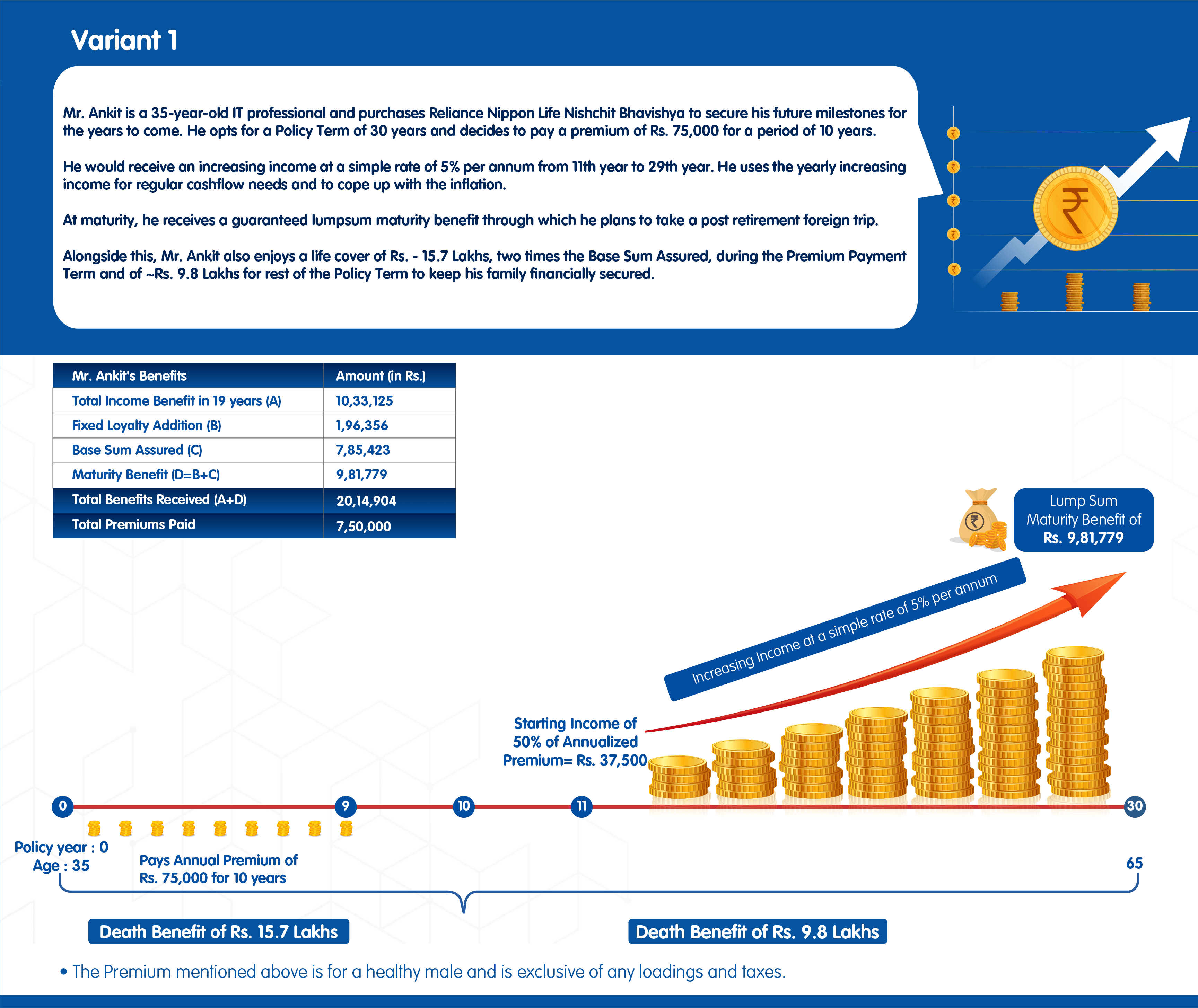

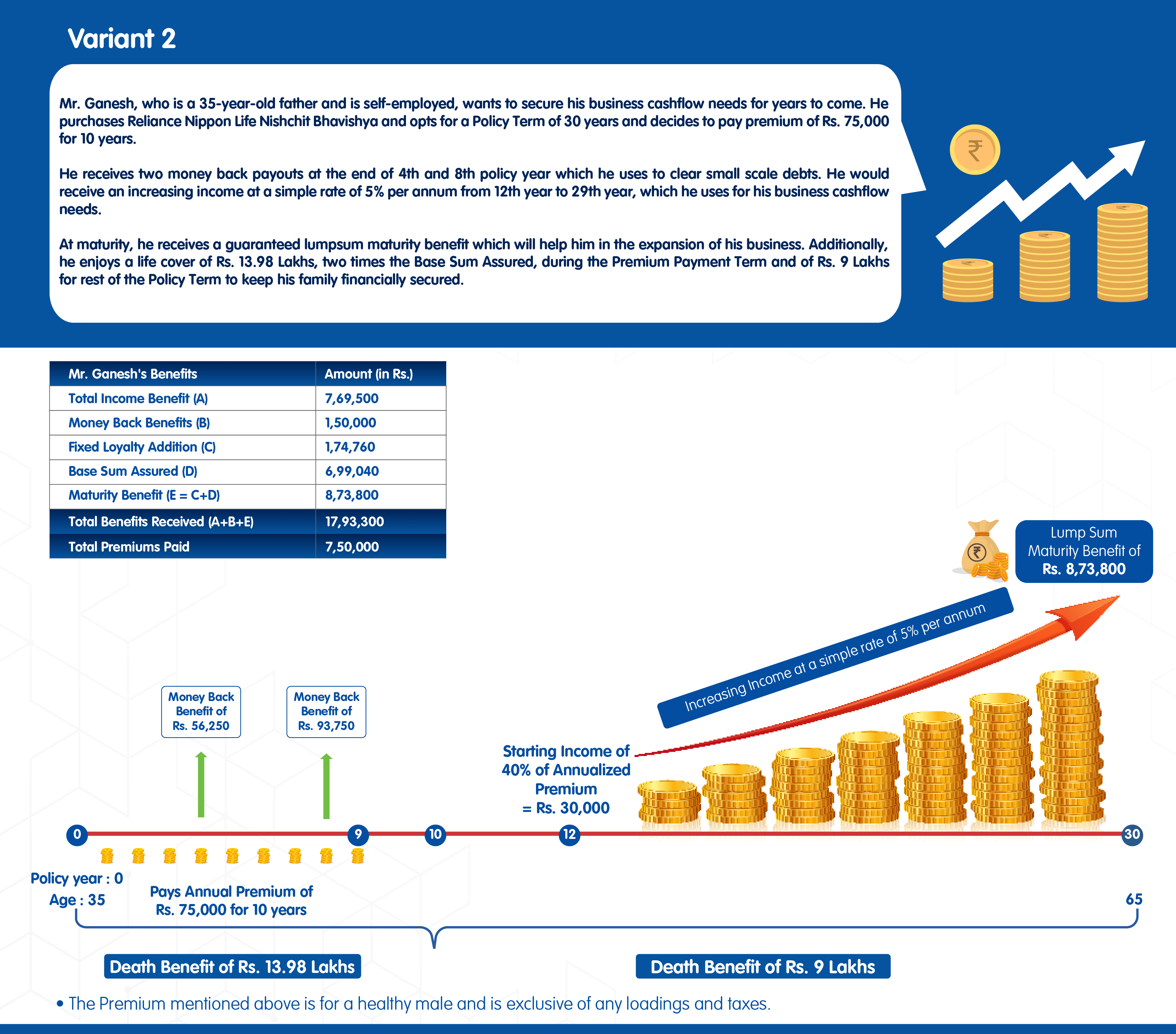

Fixed Loyalty Addition as a percentage of Base Sum Assured is as follows:

| Premium Payment Term |

Fixed Loyalty Addition (% of Base Sum Assured) |

| 8 years |

20% |

| 10 years |

25% |

| 12 years |

30% |

The policy will terminate on payment of the maturity benefit.

*Tax benefits may be applicable as per prevailing income tax laws. Tax laws are subject to change. Please consult a tax advisor.

Plan option can be chosen at policy inception only and once chosen, cannot be altered at a later date.

For more details on risk factors, terms and conditions please read sales brochure carefully before concluding a sale.

UIN for Reliance Nippon Life Nishchit Bhavishya: 121N145V01

Mktg/RNL_NB_Landing Page/V1/April23