Benefits of RNL Nishchit Samrudhi:

Guaranteed Benefits

Get long term guarantees for a period of up to 44 years

2 plan options

Receive guaranteed benefits based on your financial needs with option to choose from 2 plan options

Flexibility to pay premiums

Pay once1 or for a limited period of 6 to 11 years

Tax benefits

Save tax up to ₹46,800 u/s 80(C) on premiums paid and also receive tax benefits on benefits received u/s 10(10D)2

Enjoy benefits of guaranteed annual income for 17, 20, 23, 26, 29 or 32 years, and a financial boost by way of guaranteed lumpsum benefit at maturity by paying premiums for a limited period.

Minimum/Maximum Age at Entry3 (in years) |

PPT |

Age |

||||

| 6 | 12/55 | |||||

| 7 | 11/55 | |||||

| 8 | 10/55 | |||||

| 9 | 9/55 | |||||

| 10 | 8/50 | |||||

| 11 | 7/50 | |||||

Premium Payment Term - PPT (in years) |

6 | 7 | 8 | 9 | 10 | 11 |

Policy Term – PT (in years) |

24 | 28 | 32 | 36 | 40 | 44 |

Premium Payment Frequency |

Yearly, Half-yearly, Quarterly, Monthly | |||||

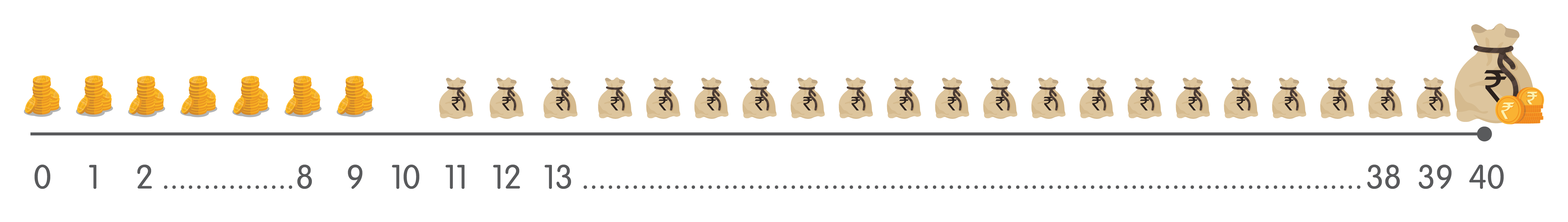

Mr. Sharma is a 45 years old IT professional and purchases Reliance Nippon Life Nishchit Samrudhi to secure his retirement for the years to come. He chooses to pay an annual premium of Rs 2 Lakhs for a premium payment term of 10 years and policy term of 40 years.

Total Premium Paid in 10 years: Rs 20,00,000

Receives a Guaranteed Annual Income of Rs.1,40,000 for 29 years

Receives a lumpsum Guaranteed Maturity Benefit of Rs.26,84,924

Mr.Sharma’s Benefits

Amount ( in Rs. )

Total Guaranteed Income Benefit for 29 years (A)

40,60,000

Guaranteed Maturity Benefit (B)

26,84,924

Total Benefits Received (A+B)

67,44,924

Total Premiums Paid

20,00,000

Mr. Sharma enjoys a life cover of Rs. 26,84,924

Premium amount shown above is for healthy male life assured, exclusive of any loadings and taxesGet your maturity benefit in the form of four equal annual installments, where the first installment payable at the end of the policy term and the remaining 3 installment are payable during the payout period.

Minimum/Maximum Age at Entry3 (in years) |

PT |

Age |

||

| 15 | 3/55 | |||

| 16 | 2/55 | |||

| 17 to 20 | 1/55 | |||

Premium Payment Term - PPT (in years) |

Single Pay | 6 | 7 | |

Policy Term – PT (in years) |

15 to 20 | |||

Premium Payment Frequency (Limited Pay) |

Yearly, Half-yearly, Quarterly, Monthly | |||

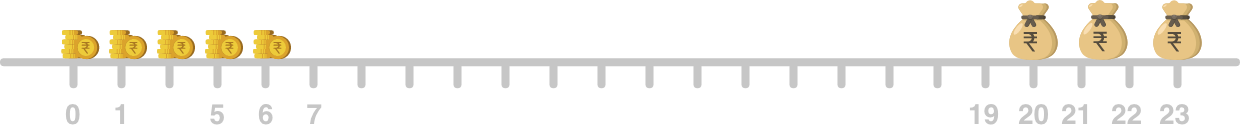

Mr. Gupta is a 35-year-old father and wishes to send his son for higher education. He purchases Reliance Nippon Life Nishchit Samrudhi to ensure his son is able to achieve his education dreams. He chooses to pay an annual premium of Rs 2 Lakhs for a premium payment term of 7 years and policy term of 20 years.

Total Premium Paid in 7 years: Rs.14,00,000

Mr. Gupta receives the Guaranteed Maturity Benefit as 4 equal instalments of Rs. 8,76,271 p.a. from 20th year onwards

Mr. Gupta Benefits

Amount ( in Rs. )

Total Maturity Benefits received

35,05,082

Total Premiums Paid

14,00,000

Mr. Gupta gets a life cover of Rs. 35,05,082

The Premium mentioned above is for a healthy male and is exclusive of any loadings and taxes

713

Extensive network of offices

(As on 31st Mar 2024)

98.74%

Claim Settlement Ratio

(Individual death claim ratio as per audited figures for FY24)

₹91,720 Cr

Total Sum Assured

(As on 31st Mar 2024)

Solvency Ratio of 227%

Against a regulatory requirement of 150%

(As on 31st Mar 2024)Frequently Asked Questions

The plan offers a choice of two plan option at inception of the policy.

- a. Income Option: The option provides guaranteed annual income for 17, 20, 23, 26, 29 or 32 years with a lumpsum benefit at maturity, depending on premium payment term chosen.

- b. Endowment Option: The option provides the maturity benefit in the form of four equal annual instalments, where the first instalment payable at the end of the policy term and the remaining 3 instalments are payable during the payout period.

On death of the Life Assured during the Policy Term provided the Policy is In-Force i.e. all due Premiums have been paid as on the date of death, and depending on the premium payment options, the Claimant is paid as follows:

Premium Payment Option |

Benefit |

| Limited Pay |

The claimant(s) shall receive the higher of:

Where, sum assured on death is defined as the higher of:

|

| Single Pay |

The claimant(s) shall receive the sum assured on death which is defined as the higher of:

|

The policy terminates on payment of the death benefit.

The Sum Assured on Death is defined as higher of:

- i. 11 times the Annualized Premium or (1.25 times the Single Premium) and

- ii. Base Sum Assured under the plan

On survival of the Life Assured, provided the policy is in-force i.e. all due premiums have been paid, the survival benefit is payable as follows;

-

a. Income Option: Guaranteed annual income shall be paid at the end of each policy year starting after the premium payment term till one year prior to end of policy term and is calculated as follows:

Premium Payment Term

Percentage of Annualized Premium

Duration of Guaranteed Annual Income Payout

6 30% From end of 7th to 23rd policy year 7 40% From end of 8th to 27th policy year 8 50% From end of 9th to 31st policy year 9 60% From end of 10th to 35th policy year 10 70% From end of 11th to 39th policy year 11 80% From end of 12th to 43rd policy year - b. Endowment Option: No survival benefit is payable under this option

On survival of the life assured to the end of the policy term, provided the policy is in-force, the following benefits will be payable, based on the plan option.

- a. Income Option: Sum Assured on Maturity payable as lumpsum where Sum Assured on Maturity is equal to Base Sum Assured.

- b. Endowment Option: Sum Assured on Maturity shall be paid in 4 equal annual instalments, where the first instalment is payable at the end of the policy term and the remaining 3 instalments are payable during the payout period.

Where, payout period is the period of 3 years from the end of policy term.

In case of death of the life assured during the payout period the outstanding maturity benefit instalment, if any, as scheduled will be payable to the claimant(s).

The policy terminates on payment of the maturity benefit.

Call Us

1800 102 1010

(Monday to Saturday: 9 am to 6 pm)

Toll Free Customer

Care Number (Pan India)