Make provision of second income and lump sum at maturity or legacy planning for your next generation.

Flexibly use this variant to seek various financial objectives

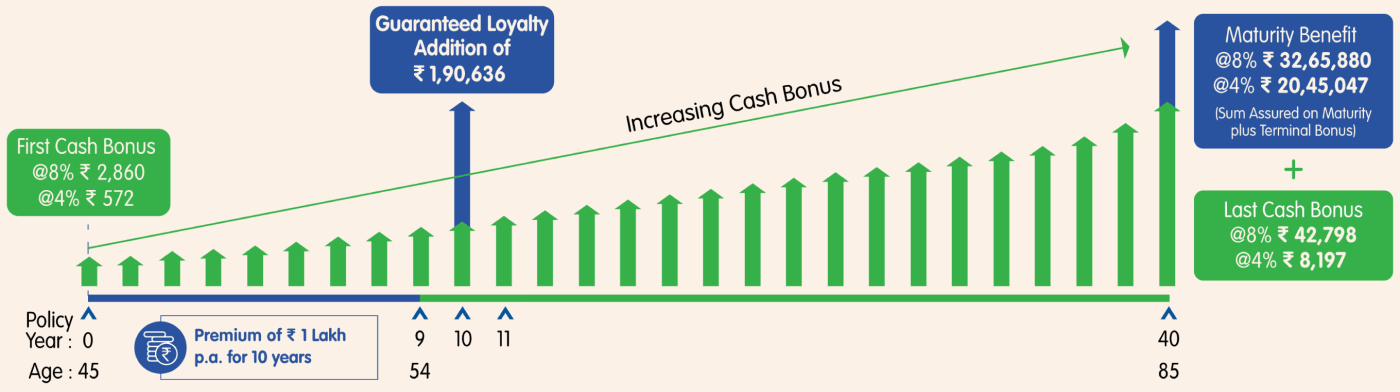

EXAMPLE 1: LIFE VARIANT USED AS PROVISION FOR SECOND INCOME

Mr. Ravi, a 45-year-old professional, is looking for a savings plan that will compliment his salary as a second income, while he is working, and also provides income for his golden years. He opts for Reliance Nippon Life Smart Total Advantage Return and chooses ‘Life Variant’. Let us see how this plan will provide Ravi a stream of income. Premium Payment Term of 10 years, Policy Term of 40 years and Premium to be paid annually is ₹1,00,000. The Base Sum Assured is ₹9,53,180.

| Benefit | Amount (in ₹) @8% | Amount (in ₹) @4% |

|---|---|---|

| Total Cash Bonus during the Policy Term (A) | 12,59,818 | 2,42,298 |

| Guaranteed Loyalty Addition (B) | 1,90,636 | 1,90,636 |

| Sum Assured on Maturity (C) | 9,53,180 | 9,53,180 |

| Terminal Bonus (D) | 23,12,700 | 10,91,867 |

| Total Benefits (A+B+C+D) | 47,16,334 | 24,77,982 |

| Total Premiums Paid | 10,00,000 | 10,00,000 |

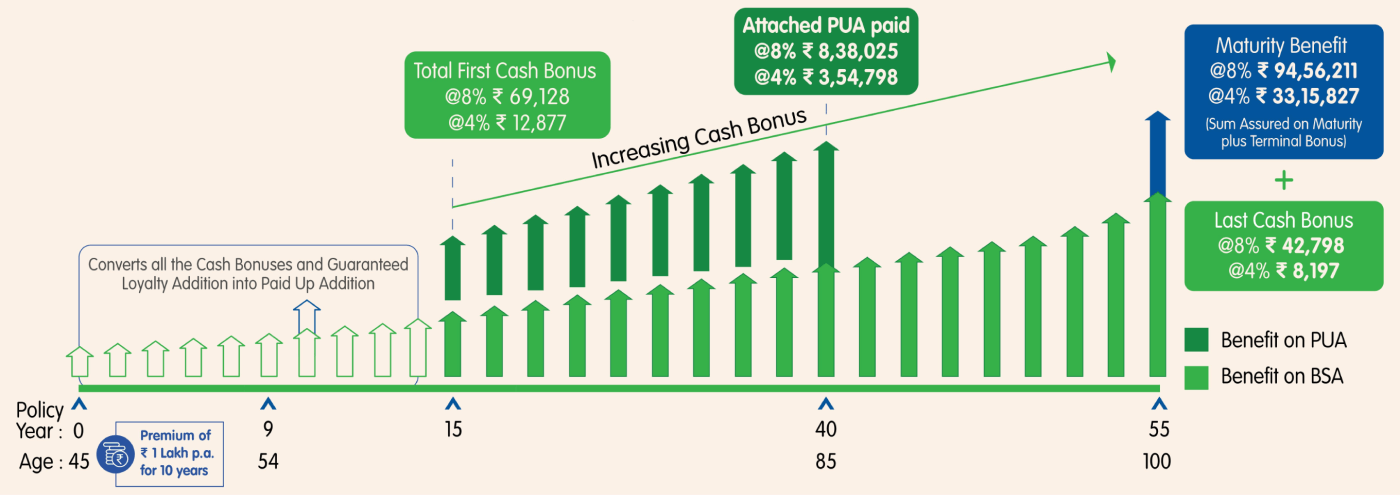

EXAMPLE 2: LIFE VARIANT WITH PAID UP ADDITION USED AS RETIREMENT PROVISION

Mr. Shrey, a 45-year-old businessman, is looking to save his income in a savings plan that will provide him with second income for his second innings. He opts for Reliance Nippon Life Smart Total Advantage Return, chooses ‘Life Variant’ and wish to convert the initial survival benefits into Paid Up Addition (PUA) till the age of 60 years. Let us see how this plan will help him to enjoy his retired life. Age of the Life Assured is 45 years, Premium Payment Term of 10 years, Policy Term of 55 years (100 minus entry age) and Premium to be paid annually is ₹1,00,000. The Base Sum Assured is ₹9,53,180.

| Benefit | Amount (in ₹) @8% | Amount (in ₹) @4% |

|---|---|---|

| Total Cash Bonus during the Policy Term (A) | 25,33,113 | 4,76,186 |

| Attached PUA paid (B) | 8,38,315 | 3,54,798 |

| Sum Assured on Maturity (C) | 9,53,180 | 9,53,180 |

| Terminal Bonus (D) | 85,03,031 | 23,62,647 |

| Total Benefits (A+B+C+D) | 1,28,27,349 | 41,46,811 |

| Total Premiums Paid | 10,00,000 | 10,00,000 |

The plan variant must be chosen at the inception of the policy and cannot be changed anytime during the policy term.

Provides benefit continuance cover, that imparts an added layer of protection, which ensures all your family’s financial objectives are met, even in your absence.

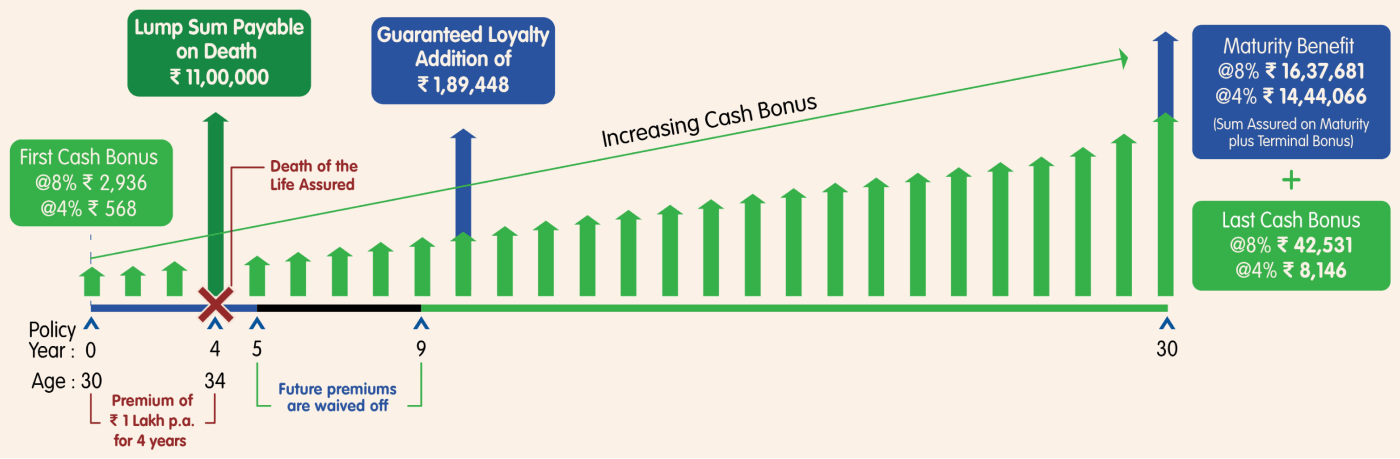

Let’s understand Life Plus Variant with the help of an illustration

EXAMPLE 3 : LIFE PLUS VARIANT USED AS A CHILD EDUCATION PLANNING TOOL

Mr. John, a 30-year-old businessman, has a daughter of 3 years old. He is looking for a savings plan that will take care of the daughter’s education expenses over the years. However, he is also worried what if something happens to him. He finds a perfect solution that covers both his needs in the form of Reliance Nippon Life Smart Total Advantage Return with ‘Life Plus Variant’.

Let us see how this plan will help John in securing his child’s future.

Premium Payment Term of 10 years, Policy Term of 30 years and Premium to be paid annually is ₹1,00,000. The Base Sum Assured is ₹9,47,239.

The plan provides regular cash flow as shown in the below illustration. As illustrated below, Mr. John faces an unfortunate death in the 4th policy year, since he opted for ‘Life Plus Variant’, his family will not only get a lump sum death benefit, but the policy will continue and his family will receive all the future benefits as would have been received if Mr. John was alive. Hence, ensuring his daughter’s education expenses in all scenarios.

| Benefit | Amount (in ₹) @8% | Amount (in ₹) @4% |

|---|---|---|

| Total Cash Bonus during the Policy Term (A) | 9,14,275 | 1,76,186 |

| Guaranteed Loyalty Addition (B) | 1,89,448 | 1,89,448 |

| Sum Assured on Maturity (C) | 9,47,239 | 9,47,239 |

| Terminal Bonus (D) | 6,90,442 | 4,96,827 |

| Lump Sum payable on Death (E) | 11,00,000 | 11,00,000 |

| Total Benefits (A+B+C+D+E) | 38,41,404 | 29,09,700 |

| Total Premiums Paid | 4,00,000 | 4,00,000 |

The plan variant must be chosen at the inception of the policy and cannot be changed anytime during the policy term.

Eligibility Criteria

The minimum & maximum age boundaries of the product are given below:

| Parameters | Life Variant | Life Plus Variant | ||

|---|---|---|---|---|

| Age at entry (Years) | Minimum | 91 (days) | 18 | |

| Maximum | 55 | |||

| Age at maturity (Years) | Minimum | 20 | 38 | |

| Maximum | Fixed Term: 95 Whole of Life: 100 | 80 |

The various Policy Term, Premium Paying Term & the corresponding minimum Annualized Premiums available under the policy across two different variants are given below:

| Life Variant & Life Plus Variant | Life Variant | ||

|---|---|---|---|

| Premium Paying Term | Fixed Policy Term (Years) | Whole of Life | |

| 20, 25, 30 & 35 | 40 | 100 minus age at entry | |

| 8 | 75,000 | 75,000 | NA |

| 10 | 50,000 | 1,00,000 | |

| 12 | |||

| 15 | |||

Premiums will vary depending upon the Age, PPT, PT & variant chosen.

There is no limit to the maximum premium under this policy and is (subject to Board Approved Underwriting Policy) Available premium payment modes in this policy are Annual, Semi-Annual, Quarterly & Monthly.

Why Reliance Nippon Life Insurance?

Faqs

There are 2 plan variants available:

- Life: A plan variant that helps you with a provision of a second income and lump sum at maturity or legacy planning for your next generation. You can flexibly use this option to customize various financial objectives like retirement planning & child education needs etc

- Life Plus: A plan variant that provides you with benefit continuance cover, that imparts an added layer of protection, which ensures all your family’s financial objectives are met, which you had dreamt of, even in your absence.

In case of unfortunate death of the Life Assured during the Policy Term, provided the policy is in-force and all due premiums have been paid as on the date of death, the nominee shall receive a lumpsum payout equal to Higher of:

- a: Sum Assured on Death plus, Terminal Bonus, if any

- b: 105% of Total Premiums Paid as on the date of death of the life assured.

Plus, Attached PUA, if any

Plus, balance in the Survival Benefit Account (SBA) if any.

The policy shall terminate on payment of the Death Benefit.

In case of unfortunate death of the Life Assured during the Policy Term, provided the policy is in-force and all due premiums have been paid as on the date of death, the nominee shall receive lumpsum payout equal to Higher of:

- a: Sum Assured on Death

- b: 105% of Total Premiums Paid as of the date of death of the life assured.

Plus, Attached PUA, if any

The policy shall not terminate on payment of the Death Benefit, and the beneficiary will continue to receive

the Survival Benefits and Maturity Benefits, as and when due, without the requirement to pay future

premiums.

Provided all due premiums have been paid by you, Cash Bonus, if any, as mentioned above will be paid to you at the end of each policy year starting from 1st Policy Year, till the end of the policy term. Additionally, a Guaranteed Loyalty Addition (GLA) will be paid to you as a one-time benefit after the completion of the premium payment term.

On survival of the Life Assured to the end of the Policy Term, provided the policy is in-force i.e., all due premiums have been paid, the following benefits will be payable:

- a: Sum Assured on Maturity; plus

- b: Terminal Bonus, if any; plus

- c: Attached PUA, if any; plus

- d: Balance in SBA, if any

where Sum Assured on Maturity is equal to Base Sum Assured

You will have an option to convert Survival Benefits i.e., Cash Bonus and Guaranteed Loyalty Addition, into participating Paid Up Addition (PUA). If opted, the Cash Bonus and Guaranteed Loyalty Addition will be converted into PUA by multiplying with the applicable PUA conversion factor. Attached PUA, if any, can also be withdrawn separately anytime, partially, or completely, without surrendering the policy.

You can accumulate your Survival Benefits in the policy in a separate Survival Benefit Account (SBA). The amount in SBA will earn an interest at the prevailing interest credit rate which will be credited to your SBA at the end of each calendar month. You can withdraw part or full amount in the SBA at any time during the Policy Term. The balance in the SBA, if any, shall be payable on death, surrender or maturity, whichever is earlier. You have the choice to opt-in and opt-out of this benefit any number of times during the policy term.