Highlights

-

EXTENSIVE COVERAGE

-

FLEXIBLE PREMIUM PAYMENTS

-

GUARANTEED ADDITIONS

-

MULTIPLE SETTLEMENT OPTIONS

-

CUSTOMIZABLE RIDERS

-

POTENTIAL TAX BENEFITS*

Example

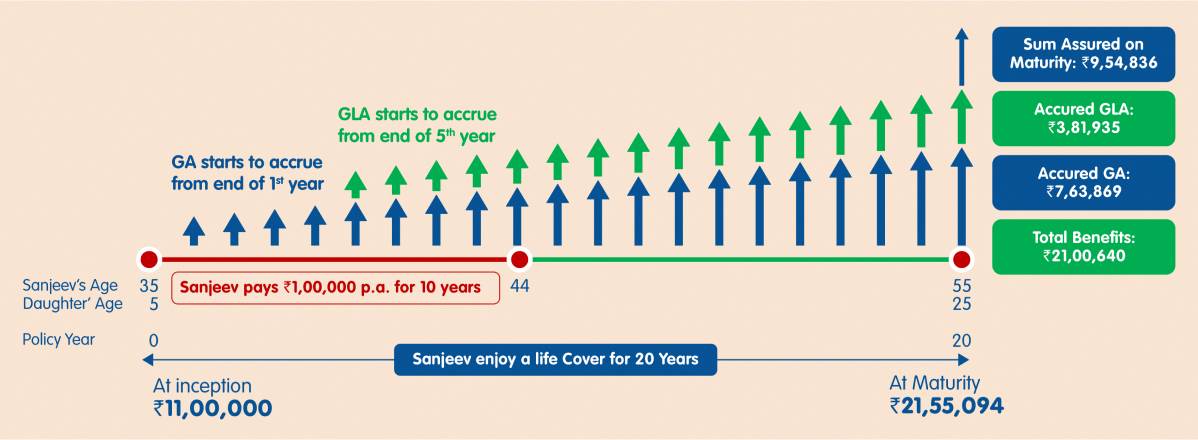

Meet Sanjeev, a 35-year-old businessman and father, focused on securing his family's future. He chose the RNL SAFE Plan, committing to an annual premium of ₹1 lakh for 10 years with a 20-year policy term. The plan provides life insurance starting at ₹11 lakhs, increasing to ₹21.5 lakhs by the end, with a Base Sum Assured of ₹9.5 lakhs - ensuring a lump sum benefit when his daughter turns 25

What makes RNL SAFE truly rewarding are the Guaranteed Additions and Guaranteed Loyalty Additions that boost maturity benefits:

- • Guaranteed Additions start after the 1st year, totaling ₹7.6 lakhs

- • Guaranteed Loyalty Additions begin after the 5th year, reaching ₹3.8 lakhs.

By the end of the 20-year term, Sanjeev will receive a total maturity benefit of ₹21 lakhs securing his daughter’s future.

Scenario I: If Sanjeev, has paid all due premiums and survives till maturity:

The premium mentioned above is for a healthy male and is exclusive of any loadings and taxes

Scenario I:

On survival till the end of the policy term, Sanjeev will receive the Maturity Benefit as specified in the table below, provided the policy is in-force i.e. all due premiums have been paid.

| Benefit | Amount (in ₹) |

|---|---|

| Base Sum Assured (A) | 9,54,836 |

| Accrued Guaranteed Additions (B) | 7,63,869 |

| Accrued Guaranteed Loyalty Additions (C) | 3,81,935 |

| Maturity Benefit (A+B+C) | 21,00,640 |

| Total Premiums Paid | 10,00,000 |

Scenario II:

In case of Sanjeev’s unfortunate demise in the 8th policy year, his nominee receives a lump sum Death Benefit as specified in the table below provided the policy is in-force i.e. all due premiums have been paid.

| Benefit | Amount (in ₹) |

|---|---|

| Sum Assured on Death (A) | 11,00,000 |

| Accrued Guaranteed Additions (B) | 1,05,032 |

| Accrued Guaranteed Loyalty Additions (C) | 71,613 |

| Death Benefit (A+B+C) | 12,76,645 |

| Total Premiums Paid till date of death | 8,00,000 |

Eligibility Criteria

| Parameters | Minimum | Maximum |

|---|---|---|

| Age at entry (Years) | 1 | 55 |

| Age at Maturity (Years) | 18 | 76 |

| Annualized Premium (₹) | ₹35,000 | No limit (subject to Board approved underwriting policy) |

| Premium payment frequency | Yearly, Half-yearly, Quarterly and Monthly | |

| Premium Payment Term & Policy Term (Years) |

Premium Payment Term | Policy Term |

| 5,7,8,10 | 15,16,20,21 | |

| 12 | 20,21 | |

| Premium Payment Option | Limited Pay | |

All the references to age are as on last birthday.

Faqs

RNL SAFE is a non-linked, non-participating individual savings life insurance plan that provides both life insurance protection and guaranteed savings. It ensures a lump sum benefit at maturity and offers additional Guaranteed Additions (GA) and Guaranteed Loyalty Additions (GLA).

The Guaranteed Additions (GA) are calculated as a percentage of the Sum Assured on Maturity and accrue at the end of each policy year. These amounts are paid either at maturity or in case of death, provided all due premiums are paid.

- You can choose from policy terms ranging from 15 to 21 years

- The available premium payment terms are 5, 7, 8, 10, and 12 years.

In the unfortunate event of the life assured’s death during the policy term, the nominee will receive:

- Sum Assured on Death (higher of 11 times the Annualized Premium or Base Sum Assured),

- 105% of total premiums paid till date of death,

along with Accrued Guaranteed Additions and Accrued Guaranteed Loyalty Additions, if any.You can enhance your coverage with the following optional riders:

- Accidental Death Benefit Rider

- Accidental Death and Disability Rider

- Accidental Death and Disability Plus Rider

- Critical Illness Rider

These riders provide additional protection in case of accidents or critical illnesses.