Highlights

-

GUARANTEED INCOME FOR LIFE1

-

LIMITED PREMIUM PAYMENT TERM

-

AVAIL LIQUIDITY IN CASE OF EMERGENCY2

-

5 ANNUITY OPTIONS TO CHOOSE FROM

-

FLEXIBILITY TO START RETIREMENT INCOME

5 ANNUITY OPTIONS TO CHOOSE FROM

FLEXIBILITY TO START RETIREMENT INCOME

2Details of Critical Illness & Disability is provided in product brochure 1Terms and Conditions applied

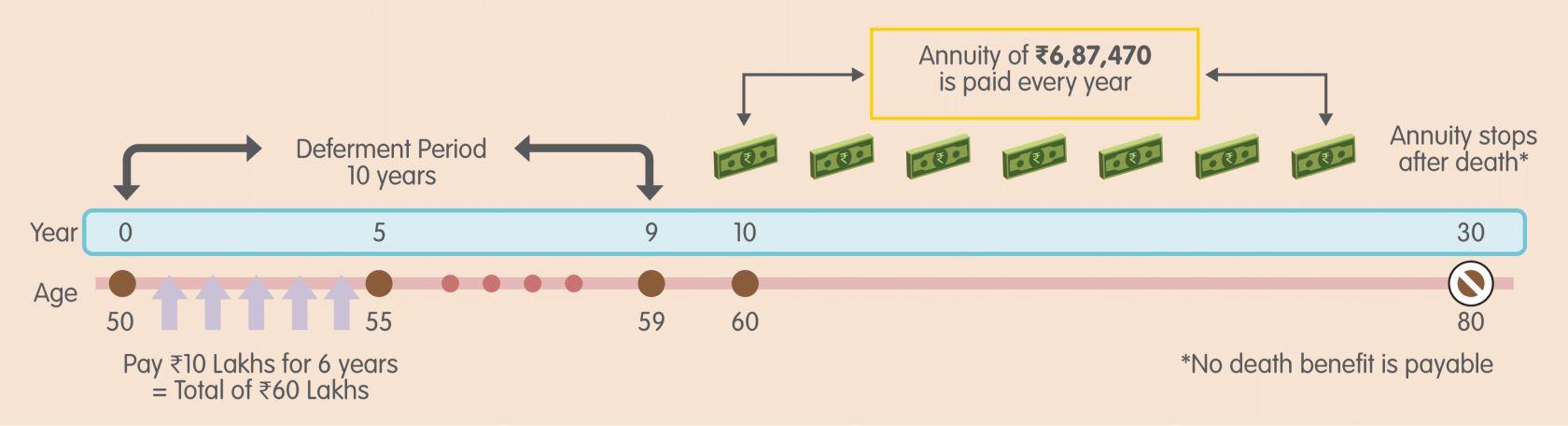

Option 1

This annuity option provides you with highest retirement income through your life and is suitable for individuals who are looking to enjoy the golden years of life to the fullest.

Let us understand through an example how this option works

EXAMPLE 1 – FOR A 50-YEAR-OLD MALE ANNUITANT

Premium Payment Term: 6 years

Deferment Period: 10 years

Annual Premium: ₹10 Lakhs

Total Premium Paid: ₹60 Lakhs

Scenario I

Mr. Singh is a 50-year-old businessman. He pays ₹10 lakhs every year for the next 6 years & choses to defer his income payout by 10 years. This way, he will be ensured with a fixed guaranteed lifelong income of ₹6,87,470 per year when he turns 60.

In case of death at the age of 80, his income will cease, and the policy shall terminate

Scenario II

If Mr. Singh passes away during the deferment period, higher of 110% of Total Premiums Paid or Surrender Value as on the date of death shall be payable and policy will terminate. No Death Benefit is payable after the completion of deferment period.

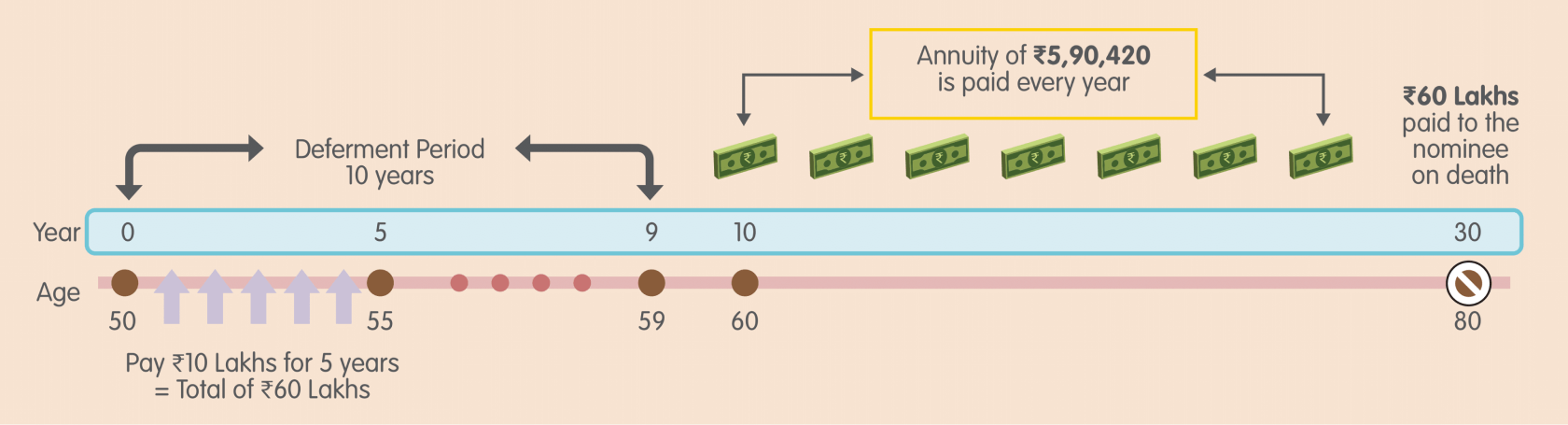

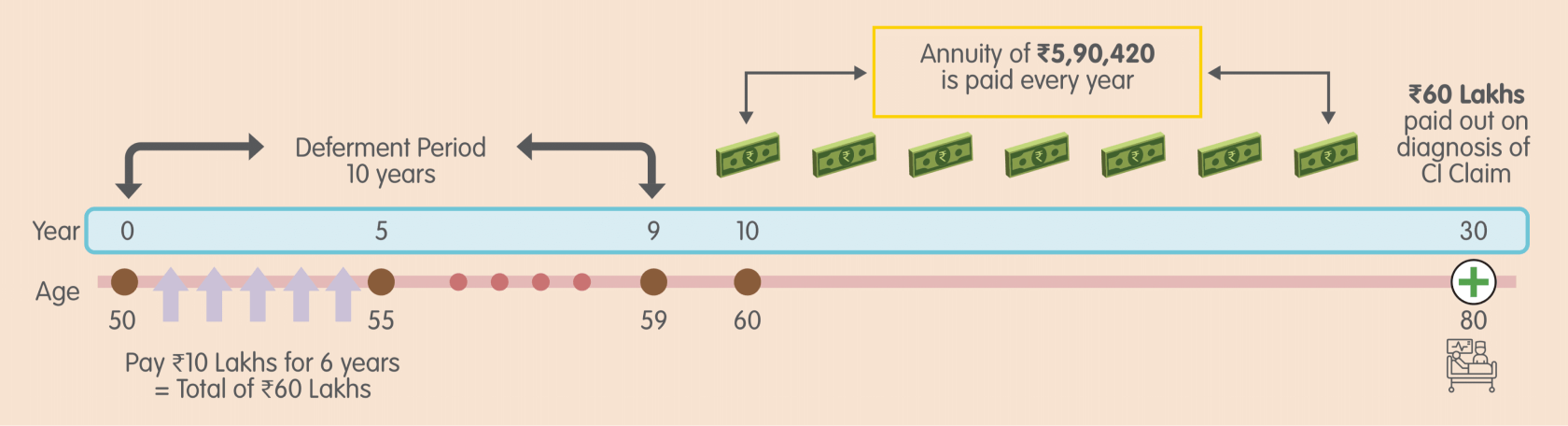

Option 2

This option helps you with a steady income during your retirement and also helps to pass on a legacy to your loved ones in your absence. In the event of diagnosis of any of the covered Critical Illnesses (CI) or occurrence of Total Permanent Disability (TPD) before attaining age 80, this option provides you the flexibility to liquidate the policy by taking CI/TPD benefit.

LET US UNDERSTAND THROUGH AN EXAMPLE HOW THIS OPTION WORKS

EXAMPLE 2 – FOR A 50-YEAR-OLD MALE ANNUITANT

Premium Payment Term: 6 years

Deferment Period: 10 years

Annual Premium: ₹10 Lakhs

Total Premium Paid: ₹60 Lakhs

Scenario I

Mr. Singh is a 50-year-old businessman. He pays ₹10 lakhs every year for the next 6 years & choses to defer his income payout by 10 years. This way, he will be ensured with a fixed guaranteed lifelong income of ₹5,90,420 per year when he turns 60.

In case of death at the age of 80, his nominee(s) will receive ₹60 lakhs and the policy will terminate.

| Total Premium Paid | Total Income Received | Death Benefit Received |

|---|---|---|

| ₹ 60 Lakhs | ~ ₹ 1.18 Crores | ₹ 60 Lakhs |

Scenario II

In the event of heart attack at the age of 80, he opts for CI/TPD benefit of ₹60 Lakhs and terminates his policy.

A comprehensive list of definitions of each Critical Illness (CI) and Total Permanent Disability (TPD) covered under the plan is mentioned in Product brochure

A comprehensive list of definitions of each Critical Illness (CI) and Total Permanent Disability (TPD) covered under the plan is mentioned in Product brochure

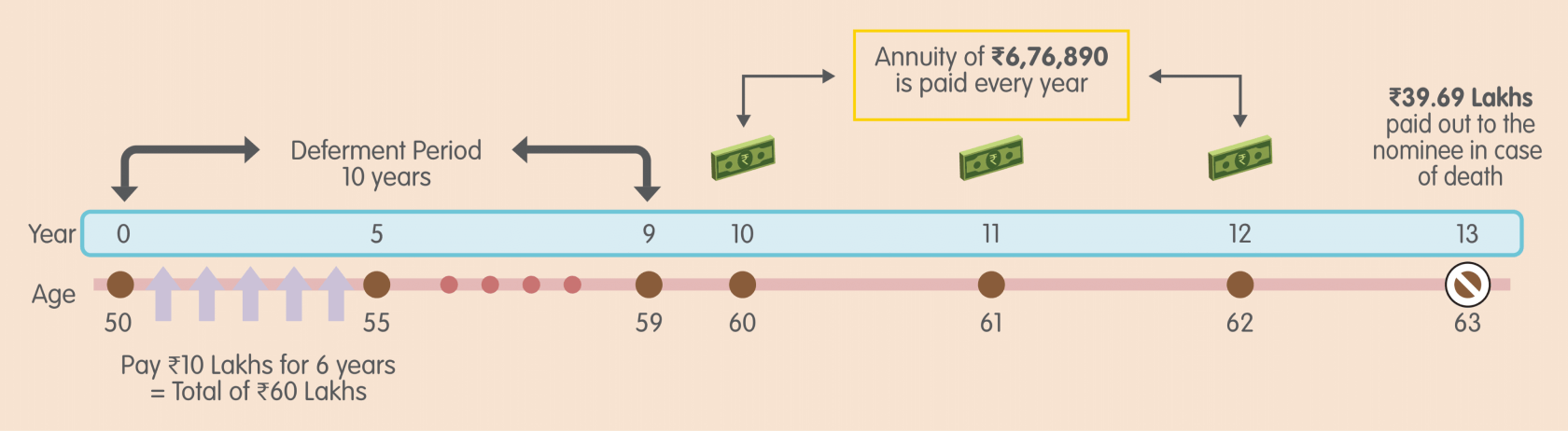

Option 3

Under this option, in the unfortunate event of policyholder’s demise post the deferment period, the sum of total premium paid less sum of all income benefit payouts is payable to the nominee. This option ensures that the minimum benefit received should not be less than the capital invested, even in case of an unfortunate early demise.

LET US UNDERSTAND THROUGH AN EXAMPLE HOW THIS OPTION WORKS

EXAMPLE 3 – FOR A 50-YEAR-OLD MALE ANNUITANT

Premium Payment Term: 6 years

Deferment Period: 10 years

Annual Premium: ₹10 Lakhs

Total Premium Paid: ₹60 Lakhs

Mr. Ganesh is a 50-year-old doctor. He pays ₹10 lakhs every year for the next 6 years & choses to defer his payout by 10 years. This way, he will be ensured with a fixed guaranteed lifelong income of ₹6,76,890 when he turns 60.

In case of unfortunate demise of Mr. Ganesh, death benefit equal to total premiums paid up to the date of death less sum of all the income payouts paid till date to him shall be payable to the nominee(s) / legal heirs in the policy.

| Age of Death | Total Income Received | Death Benefit Received | Total Benefit |

|---|---|---|---|

| 63 | ₹ 20.30 Lakhs | ₹ 39.69 Lakhs | ₹ 60 Lakhs |

| 80 | ~ ₹ 1.35 Crores | Nil | ~ ₹ 1.35 Crores |

Capital of Rs. 60 Lakhs remains preserved even in case of an early demise.

Option 4

This option is designed to ensure guaranteed income to the couples as long as they live. They can now leave their worries behind because this plan shall pay regular income not only to them, but also to their partner for lifetime. In the event of death of both the partners after the deferment period the policy shall be terminated.

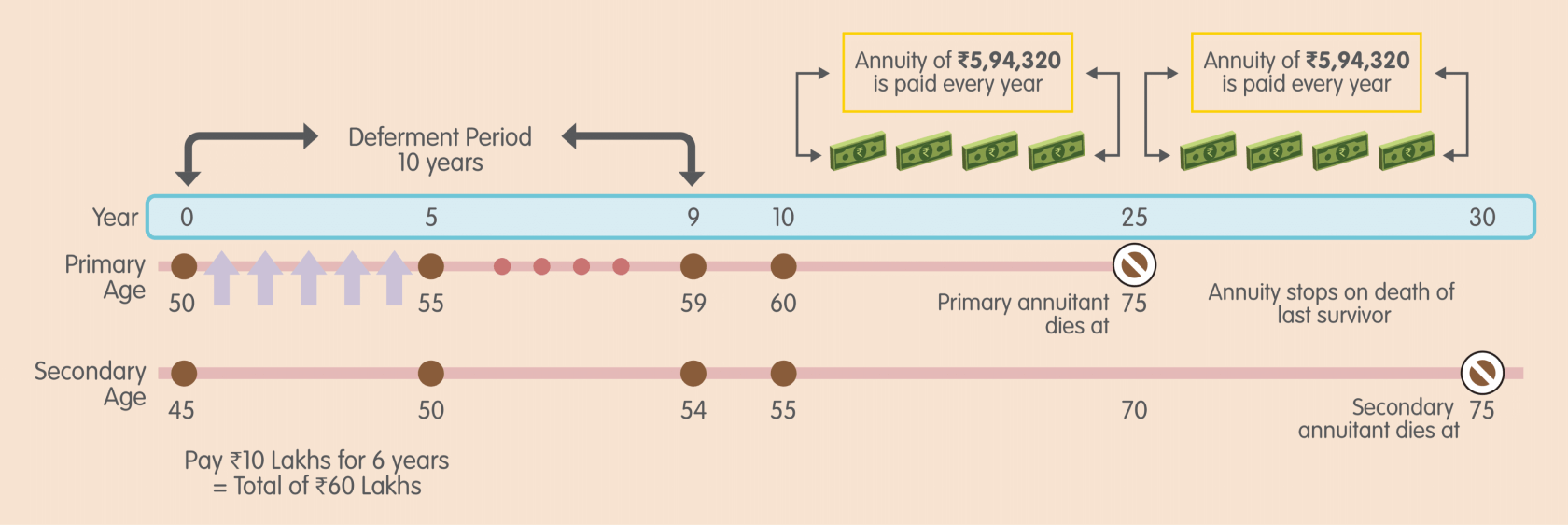

LET US UNDERSTAND THROUGH AN EXAMPLE HOW THIS OPTION WORKS

EXAMPLE 4 – FOR A 50-YEAR-OLD MALE PRIMARY ANNUITANT & 45-YEAR-OLD FEMALE SECONDARY ANNUITANT

Premium Payment Term: 6 years

Deferment Period: 10 years

Annual Premium: ₹10 Lakhs

Total Premium Paid: ₹60 Lakhs

Mr. Ganesh is a 50-year-old doctor. He pays ₹10 lakhs every year for the next 6 years & choses to defer his payout by 10 years. This way, he will be ensured with a fixed guaranteed payout of ₹5,94,320 when he turns 60.

In case of unfortunate demise of Mr. Ganesh (primary annuitant), the income payouts shall be continued & will be paid to the secondary annuitant (Ruchita)

On death of the last surviving annuitant i.e. on death of both the primary & secondary annuitant, no death benefit shall be payable and the policy will terminate.

Option 5

This option provides guaranteed lifetime income not only to the policyholder and their partner for the entire life, but also leave a legacy for their loved ones. In the event of any of the annuitants being diagnosed with any of the covered Critical Illnesses (CI) or occurrence of Total Permanent Disability (TPD) before attaining age 80, they have the flexibility to terminate the policy by taking the CI/TPD benefit.

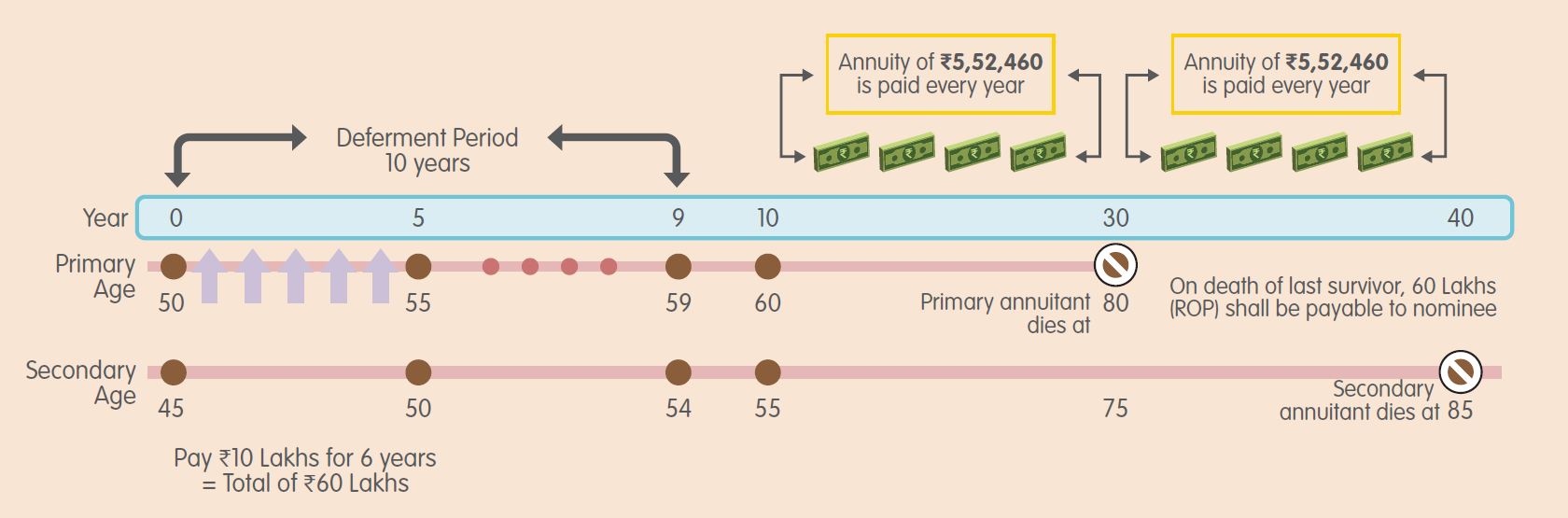

LET US UNDERSTAND THROUGH AN EXAMPLE HOW THIS OPTION WORKS

EXAMPLE 5 – FOR A 50-YEAR-OLD MALE PRIMARY ANNUITANT & 45-YEAR-OLD FEMALE SECONDARY ANNUITANT

Premium Payment Term: 6 years

Deferment Period: 10 years

Annual Premium: ₹10 Lakhs

Total Premium Paid: ₹60 Lakhs

Mr. Ganesh is a 50-year-old doctor. He pays ₹10 lakhs every year for the next 6 years & choses to defer his payout by 10 years. This way, he will be ensured with a fixed guaranteed payout of ₹5,52,460 when he turns 60.

In case of unfortunate demise of Mr. Ganesh at age 80, the income payouts shall be continued & will be paid to the secondary annuitant (Ruchita). On death of the last surviving annuitant i.e. Ruchita at age 85, the nominee / legal heir receives ₹60 Lakhs and the policy will terminate.

For all the above annuity options, income benefit/annuity payouts shall be payable post completion of the deferment period as per the annuity option chosen at inception and described above. The annuity option chosen at inception cannot be altered anytime later in this policy.

Eligibility Criteria

| Parameter | Minimum | Maximum |

|---|---|---|

| Age at Entry (years) | 30 | 75 |

| Minimum Premium |

Option 2: ₹75,000 Options 1, 3, 4 & 5: ₹1,00,000 |

No Limit |

| Vesting Age (years) | 35 | 80 |

| Premium Paying Term (years) | Deferment Period (years) |

|---|---|

| 5 | 5,6,7,8,9,10,15 |

| 6 | 6,7,8,9,10,15 |

| 7 | 7,8,9,10,15 |

| 8 | 8,9,10,15 |

| 10 | 10,15 |

| Premium Payment Frequency | Yearly, Half Yearly, Quarterly & Monthly |

| Annuity Payout Frequency | Yearly, Half Yearly, Quarterly & Monthly |

All the references to age are based on age last birthday

Why Reliance Nippon Life Insurance?

Faqs

- Single Life Annuity

- Single Life Annuity with Return of Premium plus CI/TPD benefit

- Single Life Annuity with Return of Balance of Premium:

- Joint Life Annuity

- Joint Life Annuity with Return of Premium plus CI/TPD Benefit

|

During |

All Annuity Options: No Annuity payment shall be made during the deferment period |

|---|---|

|

After |

Option 1, 2 & 3: Annuity payment shall be made in arrears as per the chosen payment frequency as long as the annuitant is alive. |

|

Option 4 & 5: Annuity payment shall be made in arrears as per the chosen payment frequency as long as either one of the annuitant(s) are alive. |

In case of unfortunate death of the annuitant(s) provided the Policy is In-force i.e., all due premiums have been paid as on the date of death, the Claimant(s) shall receive higher of:

| Policy Year | Benefit |

|---|---|

|

During |

Option 1, 2 & 3: higher of 110% of Total Premiums Paid or Surrender Value as on the date of death shall be payable. Option 4 & 5: On death of the last surviving annuitant i.e. on death of both the Annuitants, higher of 110% of Total Premiums Paid or Surrender Value as on the date of death shall be payable |

|

After |

Option 1 & 4: No death benefit is payable Option 2: Total Premiums Paid upto the date of death shall be payable. Option 3: Total Premiums Paid less sum of all the Annuity payments paid up to the date of death under the policy subject to minimum of zero. Option 5: On death of the last surviving annuitant i.e. on death of both the Annuitants, Total Premiums Paid upto the date of death of surviving annuitant shall be payable. |

The policy terminates on payment of the death benefit to the Claimant(s).

| Critical Illness / Total Permanent Disability Benefit available under plan option 2 & 5 | |

|---|---|

|

During Deferment Period |

In the event of diagnosis of any one of the covered Critical

Illness (CI) or on occurrence of Total Permanent Disability

(TPD) to the Annuitant, before the attainment of the age of 80

years, the Policyholder shall have an option to continue the

Policy or terminate the policy by taking the following CI/TPD

benefit: This is an optional benefit, and the annuitant(s) may continue with the policy as per his/her convenience, without opting the CI/TPD benefit claim. |

Deferment Period (DP) is the period which starts from the Date of Commencement of Policy and is more than or equal to the Premium Paying Term (PPT). Post the Deferment Period, first Annuity becomes payable to the Annuitant. Policyholder has an option to choose Deferment Period.